Mysteries of the Mind with Dr. Theodore Schwartz

On a special episode of the Walker Webcast, Willy sat down with Dr. Theodore Schwartz—one of the nation’s leading neurosurgeons and author of Gray Matters: A Biography of Brain Surgery—at the Sun Valley Writers’ Conference. Together, they discussed Dr. Schwartz’s approach to patient care and balancing transparency with compassion, making the decision to become a neurosurgeon, the power of the human brain, cutting edge technologies like Deep Brain Stimulation and Brain Computer Interface, and so much more. Key Points In The Webcast: 00:00 Introduction 01:25 Willy introduces Dr. Theodore Schwartz 04:27 What Dr. Schwartz does after a biopsy 10:29 Leading patients with hope 12:51 Determining tumor aggression and quality of life 15:17 How does brain mapping work? 18:26 Dr. Harvey Cushing, the founder of neurosurgery 19:27 Dr. Cushing’s education and early discoveries 22:41 What Dr. Schwartz does after a patient passes 24:56 How to be reliable: Personal and professional 28:26 Practicing transparency and honesty 30:30 The history of Dr. Schwartz’ parents 35:53 Celebrating Dr. Schwartz’ mother’s 90th birthday 36:13 Why “Gray Matters”? 37:39 How Dr. Schwartz would respond to a diagnosis 39:39 Dr. Wilfeld Penfield’s discoveries on language and the brain 41:38 New technologies for Parkinson’s 44:21 AI and brain-computer interface 48:27 Leo Davidoff and Tracy Putnam 53:08 Cochlear implant vs. brain-computer interface 53:51 A non-invasive brain surgery success story GET NOTIFIED about upcoming shows: » Subscribe to our YouTube channel here: https://www.youtube.com/channel/UC5jhzGBWOTvQku2kLbucGcw » See upcoming guests on the #WalkerWebcast here: https://www.walkerdunlop.com/webcasts Related webcasts: Tune in on Wednesdays for fresh perspectives about leadership, business, the economy, commercial real estate, and more! #WillyWalker hosts a diverse network of leaders as they share the wisdom that cuts across industry lines. Check out our previous videos: » Full playlist: https://www.youtube.com/playlist?list=PL_QkMqEzOkzNmWUe9kpfRJ4213jIh6LNk Apple Podcasts: https://podcasts.apple.com/us/podcast/driven-by-insight/id1540843402 Spotify: https://open.spotify.com/show/1z3wDGMAjtscNhKWJfXs7L Follow us: » LinkedIn: https://www.linkedin.com/company/walker-&-dunlop/ » Facebook: https://www.facebook.com/WalkerDunlop » Twitter: https://twitter.com/WalkerDunlop » Instagram: https://www.instagram.com/walkerdunlop/ POSTING POLICY: Please bear in mind that this is a public and professional platform. We’ll do our best to ensure that our postings on this page comply with our standards, which prohibit content that: • is abusive, defamatory, threatening, or obscene • is fraudulent, deceptive, or misleading • violates the copyright, trademark, patent, trade secret, right of privacy, right of publicity, or other intellectual property right of another • contains or links to any virus, worm, Trojan horse, or other forms of malware or harmful code • contains the personal information of others, such as names, addresses, and telephone numbers • violates any law or regulation • is otherwise offensive. We expect users not to post content that violates our standards. We cannot monitor postings or discussions in advance, but we reserve the right to remove any posting that does not meet our standards. source

Can the U.S. weaken the dollar without losing its global power?

The U.S. dollar’s global dominance is both a strength and a self-inflicted wound. As Trump’s team pushes for a weaker dollar to revive domestic industry, they’re walking a geopolitical tightrope with no safety net. Watch this #WalkerWebcast to hear why balancing a strong reserve currency with economic revival is proving to be one of the most perilous economic maneuvers of our time. #DollarDilemma #TradeDeficit #CapitalFlows #ReserveCurrency #TrumpEconomics #USManufacturing #CurrencyStrategy #WalkerWebcast #EconomicPolicy #GlobalMarkets source

Can you spot the water you’re swimming in?

In a world shaped by polarization and blind spots, seeing clearly requires stepping outside your own fishbowl. Anthropology isn’t just about faraway cultures; it’s a vital tool for uncovering hidden risks and opportunities in modern business. Listen to this #WalkerWebcast to learn how adopting an outsider’s lens can sharpen your strategy in a world upended by political shifts and global complexity. #GlobalPerspective #AnthropologyInBusiness #CriticalThinking #CognitiveBias #CulturalIntelligence #PoliticalPolarization #WalkerWebcast #LeadershipMindset #BlindSpots #InsiderOutsiderView source

Is it time to bet against fiat currency?

As fiat currencies face unprecedented tail risks, real assets are stepping into the spotlight. Gold, timber, and real estate are rising stars in a volatile financial landscape. Watch this #WalkerWebcast to hear why tangible assets may hold the key to stability, and why real estate could be in the best position of all. #RealAssets #FiatCurrency #GoldInvestment #Timberland #RealEstateInvesting #MarketVolatility #WalkerWebcast #EconomicOutlook #HardAssets #WealthPreservation source

Tariffs explained in under 60 seconds #USAFacts #TariffsExplained #In60SecondsOrLess

source

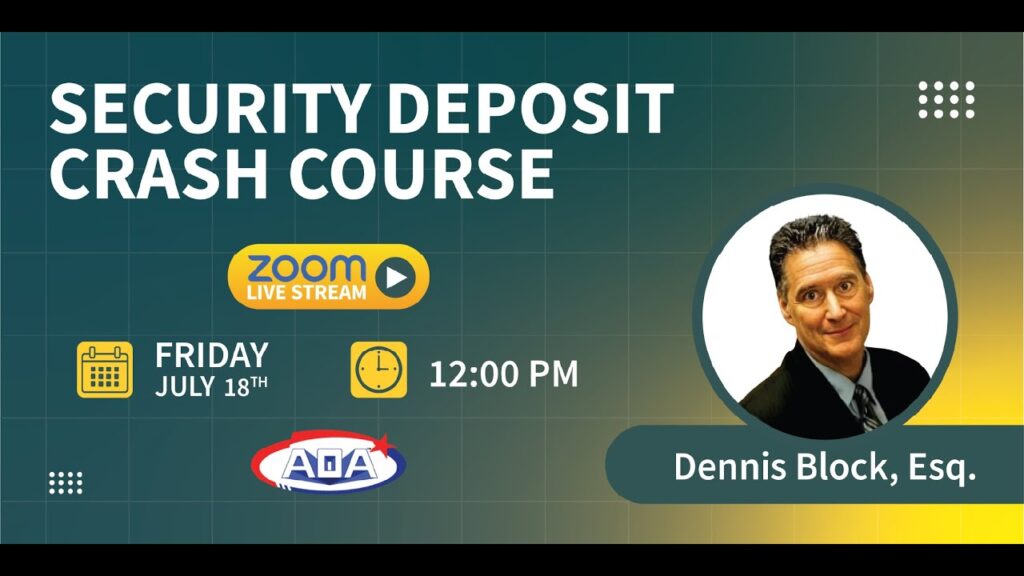

Security Deposit Crash Course

Dennis Block, Esq. | The Law Firm of Dennis Block and Associates Disclaimer: The information shared in this [live stream -or- … source

Seizing Opportunity Amid Global Shifts with Gillian Tett

On this special episode of the Walker Webcast, recorded live at the Walker & Dunlop Summer Conference, guest host Gary Pinkus — Walker & Dunlop board member and former Chairman of McKinsey & Company — sits down with Gillian Tett, award-winning journalist, author, Chair of the Financial Times’ Editorial Board, and Provost of King’s College, Cambridge. You won’t want to miss Gillian’s unique perspective on everything from the global repercussions of the Trump presidency and the use of tariffs as a political lever, to shifting ESG narratives, varying attitudes about AI worldwide, the politicization of higher education, and what all this means for the future of real estate. Key Points In The Webcast: 00:00 Introduction 05:21 Gary Pinkus introduces Gillian Tett 07:19 Gillian’s education and professional experience 08:56 The link between anthropology, human behavior, and economics 12:10 How the first Trump presidency was a surprise 18:12 Why the economic world view is under attack 25:43 How is ESG impacting the zeitgeist shift? 30:02 Where the Fed and interest rates are headed 38:28 The effect of SLR on interest rates 40:41 How the U.S. is forcing countries to buy government debt 43:14 Addressing Jerome Powell rumors 45:29 Discussing the $137 billion in tariffs 51:37 Where does the U.S. stand in the world now? 56:13 Why the U.S. fiscal problems will explode dramatically 57:23 The politicization of higher education 01:02:06 Are researchers returning to their home countries? 01:06:34 AI, human connection, and trust 01:13:49 The future of real estate GET NOTIFIED about upcoming shows: » Subscribe to our YouTube channel here: https://www.youtube.com/channel/UC5jhzGBWOTvQku2kLbucGcw » See upcoming guests on the #WalkerWebcast here: https://www.walkerdunlop.com/webcasts Related webcasts: Tune in on Wednesdays for fresh perspectives about leadership, business, the economy, commercial real estate, and more! #WillyWalker hosts a diverse network of leaders as they share the wisdom that cuts across industry lines. Check out our previous videos: » Full playlist: https://www.youtube.com/playlist?list=PL_QkMqEzOkzNmWUe9kpfRJ4213jIh6LNk Apple Podcasts: https://podcasts.apple.com/us/podcast/driven-by-insight/id1540843402 Spotify: https://open.spotify.com/show/1z3wDGMAjtscNhKWJfXs7L Follow us: » LinkedIn: https://www.linkedin.com/company/walker-&-dunlop/ » Facebook: https://www.facebook.com/WalkerDunlop » Twitter: https://twitter.com/WalkerDunlop » Instagram: https://www.instagram.com/walkerdunlop/ POSTING POLICY: Please bear in mind that this is a public and professional platform. We’ll do our best to ensure that our postings on this page comply with our standards, which prohibit content that: • is abusive, defamatory, threatening, or obscene • is fraudulent, deceptive, or misleading • violates the copyright, trademark, patent, trade secret, right of privacy, right of publicity, or other intellectual property right of another • contains or links to any virus, worm, Trojan horse, or other forms of malware or harmful code • contains the personal information of others, such as names, addresses, and telephone numbers • violates any law or regulation • is otherwise offensive. We expect users not to post content that violates our standards. We cannot monitor postings or discussions in advance, but we reserve the right to remove any posting that does not meet our standards. source

Are investors underestimating how quickly multifamily returns will rebound?

Multifamily concessions could vanish faster than expected, triggering a sudden income surge. Many are underwriting slow recovery, but the market may flip in months, not years. Tune into this #WalkerWebcast to hear why Willy Walker believes the burn-off of rent concessions could surprise the market and what that means for multifamily investors. #WalkerWebcast #MultifamilyHousing #RealEstateTrends #RentConcessions #CREInsights #MultifamilyMarket #InvestmentStrategy source

Is higher education losing its value in the AI era?

A new BLS study flips the script on education and employment. Associate degrees are thriving while advanced degrees face rising joblessness. Watch this #WalkerWebcast as Willy Walker and Dr. Peter Linneman unpack shocking employment data and what it says about the shifting value of college degrees in today’s job market. #WalkerWebcast #LaborMarketTrends #HigherEdCrisis #AIImpact #FutureOfWork #EducationEconomy #JobMarketShift source

Will the Fed really cut rates by a full point before 2026?

A year ago, Peter Linneman called the Fed’s moves and nailed it. Now he’s betting on 100 basis points of cuts by year-end, with a bet for new shoes on the line. Watch this #WalkerWebcast to hear Willy Walker and Dr. Peter Linneman revisit past predictions and make bold new bets on the Fed’s next moves. #WalkerWebcast #FederalReserve #InterestRates #EconForecast #FedPolicy #RateCuts #EconomicOutlook source